|

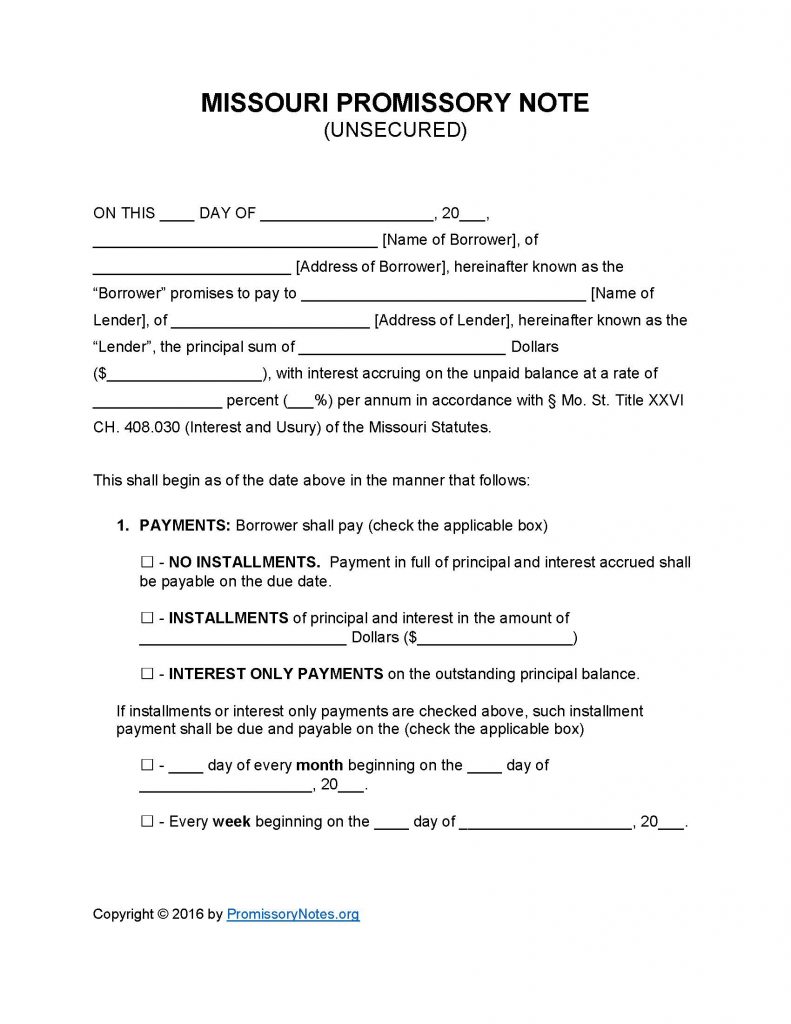

Missouri Unsecured Promissory Note Template |

The Missouri Unsecured Promissory Note Template is a written agreement, entered into by a lender and borrower, that outlines the principal sum, installment/payment amount, interest rate(s), and other facets of a loan. Unsecured notes, unlike secured ones, are not backed by assets pledged from the borrower. In the event of default, the lender’s only recourse is to file a civil suit against the borrower. Due to the inherent risk of loss for the lender, unsecured notes are typically only used for borrowers who are “low risk.”

How to Write

Step 1 – The template can be downloaded in .PDF or Word format via the links near the top of the page.

Step 2 – Provide the following details (in the opening paragraph):

- Date

- Name of borrower/borrower’s address

- Name of lender/lender’s address

- Loaned amount (principal sum) – enter in USD

- Interest rate

Step 3 – Payments:

- Submit the payment method by checking the box that corresponds to the agreed upon method.

- If the selected payment system is “Installments” or “Interest Only,” the monthly OR weekly payment frequency must be entered in the provided format.

Step 4 – Due Date:

- Enter the principal sum’s due date.

Step 5 – Late Fees:

- Fill the period of time after the initial due date that the borrower will have to make a payment (before the lender can apply a late fee to the owed amount).

- Provide the late fee that will be charged in the event of a missed payment.

Step 6 – Acceleration:

- In the event of default, the borrower will have the period of time submitted in this subsection to “cure” the default. If the borrower fails to cure the default within the described number of days, the lender can take further action (litigation, etc.).

- Submit the period of time (in days).

Step 7 – Signatures:

- Submit the date in dd/m/yy format

- Borrower’s name

- Lender’s name

- Signature of borrower

- Signature of lender

- Names and signatures of witnesses

Missouri Unsecured Promissory Note – Adobe PDF – Microsoft Word