|

North Carolina Secured Promissory Note Template |

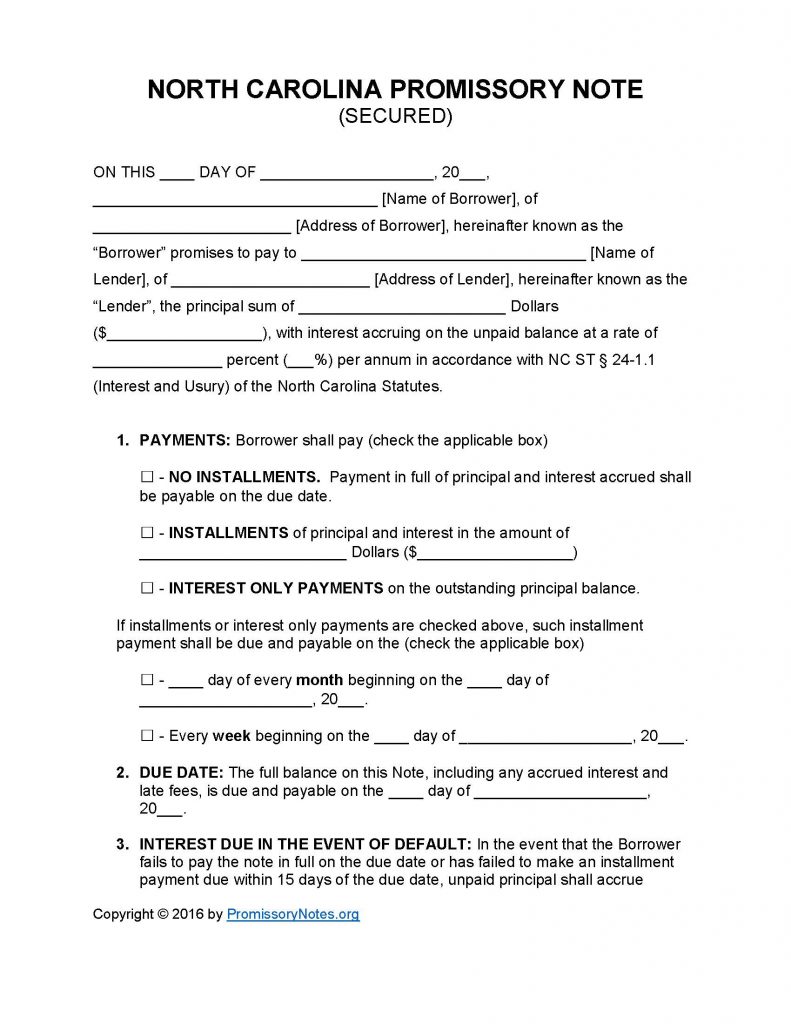

The North Carolina Secured Promissory Note Template may be downloaded via the links posted on this page. The templates are available in two different formats: .PDF and Word. The templates are simple, straightforward forms that can be filled out in a matter of minutes. Promissory notes cover the various terms of a loan. Secured promissory notes require that the borrower pledge some form of collateral (in exchange for receiving a loan from the lender).

How to Write

Step 1 – Download the document in the file format of your choice.

Step 2 – Enter the following details:

- Date

- Name/address of borrower

- Name/address of lender

- Principal sum

- Interest percentage

Step 3 – Payments:

- Provide the borrower’s method of repayment.

- Enter the installment amount (if applicable).

- Submit the monthly/weekly installment schedule (if required).

Step 4 – Due Date:

- Fill in the due date of the principal sum.

Step 5 – Interest Due in Event of Default:

- This subsection details the interest rate that the borrower will be charged if they default on the loan.

Step 6 – Late Fees:

- The “Late Fees” subsection outlines how long the borrower will have (after missing a scheduled payment) before a late fee can be charged by the lender.

- Submit how much the borrower will be charged should they miss a scheduled payment.

Step 7 – Acceleration:

- Enter how much time the borrower will have to cure a default. Submit the time in days (numerical format).

Step 8 – Security:

- Fill in the collateral/security of the borrower.

Step 9 – Signatures – The following information is required in order for the form to be legally enforceable:

- Date

- Names of borrower, lender, witnesses

- Signature of borrower

- Signature of lender

- Signatures of witnesses

North Carolina Unsecured Promissory Note – Adobe PDF – Microsoft Word