|

North Dakota Unsecured Promissory Note Template |

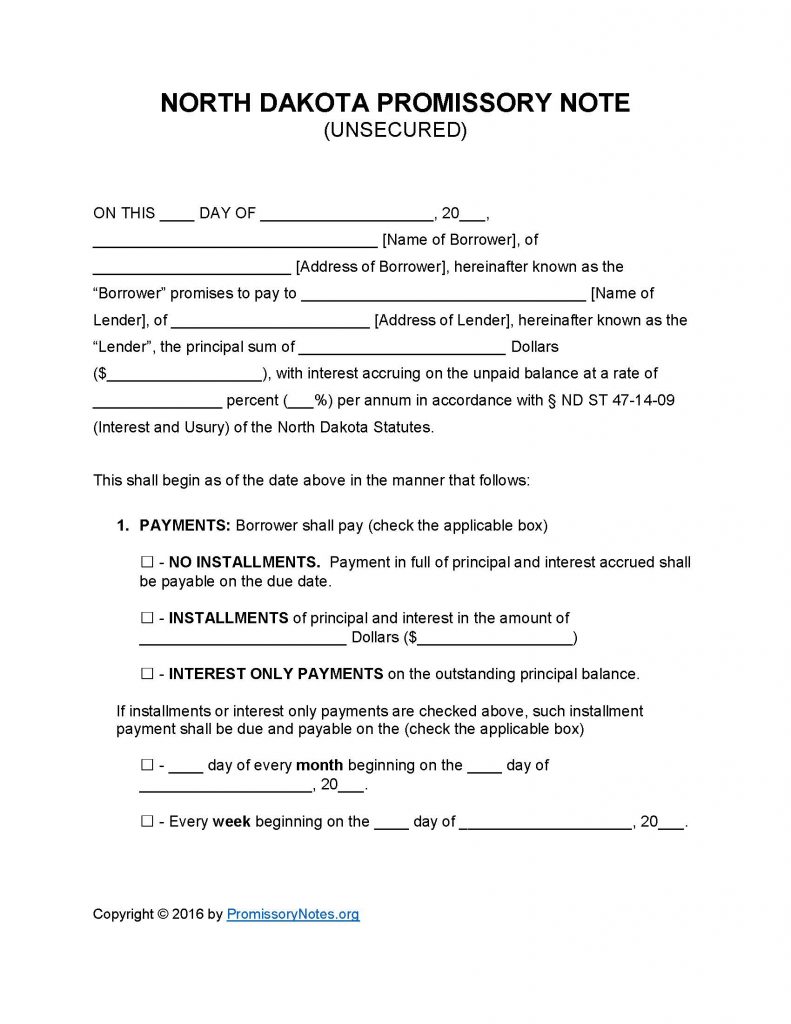

The North Dakota Unsecured Promissory Note Template is a type of contract that is entered into by a lender and borrower. The contract details the parties (lender/borrower) and terms of loan (loaned amount, interest rate, repayment method/schedule, due dates, etc.). The template can be downloaded in .PDF or Word format. The .PDF template can be completed electronically (using Acrobat). Use the information posted below as a reference when drafting the unsecured promissory note template.

How to Write

Step 1 – Download the agreement in the format of your choice (download links at the top of the page).

Step 2 – The following details must be entered into the first paragraph of the agreement:

- Date

- Name of borrower

- Address of borrower

- Name of lender

- Address of lender

- Loaned amount

- Interest percentage (per annum)

Step 3 – Payments – The payment method must be selected by checking the appropriate box (choose from the following options):

- No Installments

- Installments

- Interest Only

Step 4 – Due Date:

- The date entered into this subsection is when the full balance of the loan must be paid (in full) by.

Step 5 – Interest Due in Event of Default:

- Fill what interest rate the borrower will be charged (in the event of a default on the loan).

Step 6 – Late Fees:

- If the borrower misses a scheduled installment, they will have the number of days submitted in this subsection to pay the past-due amount.

- If the borrower does not make the payment within the agreed upon number of days, they will be charged a late fee. Submit the amount they will be charged.

Step 7 – Acceleration:

- Enter the period of time the borrower will have, after defaulting on the loan, to “cure” the default. If the balance is not brought current within this time period, the lender can take legal action against the borrower.

Step 8 – Signatures:

- Fill in the date (dd/m/yy format).

- Provide the printed names of the borrower, lender, and witnesses.

- In order for the agreement to be legally valid it MUST be signed by ALL parties (borrower, lender, witnesses).

North Dakota Unsecured Promissory Note – Adobe PDF – Microsoft Word