|

New Mexico Unsecured Promissory Note Template |

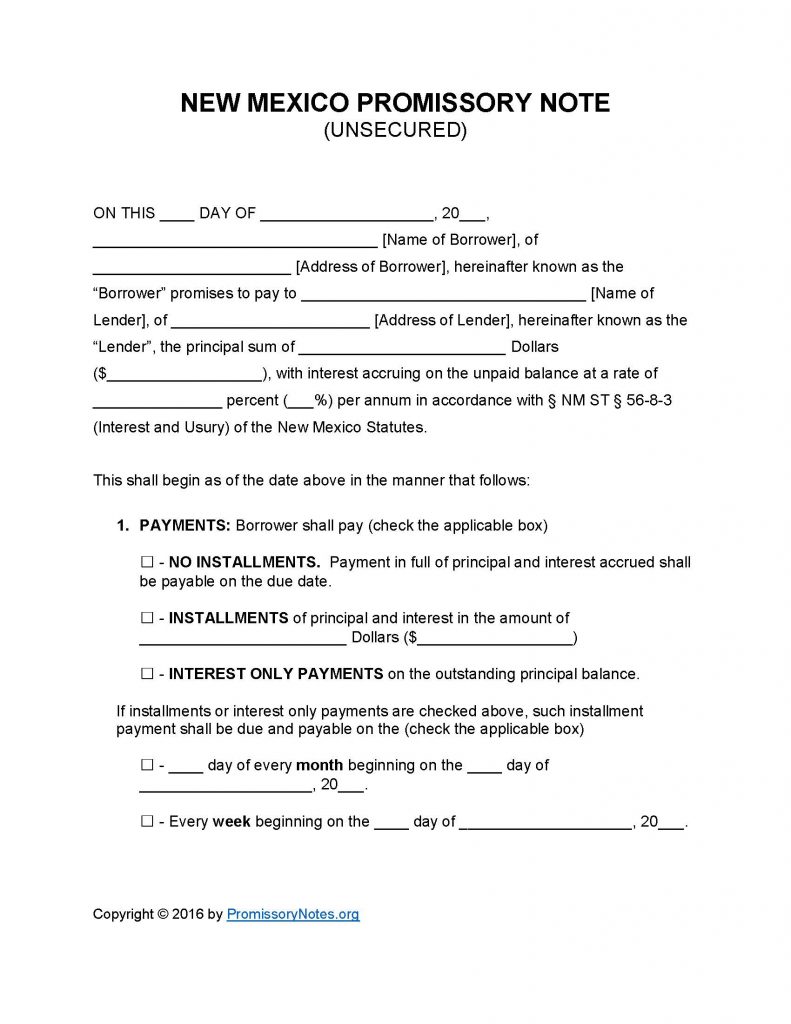

The New Mexico Unsecured Promissory Note Template provides the fixed interest rate, principal sum, installment amount, payment frequency, and other terms of a loan. Unsecured notes do not require that the borrower pledge security in exchange for receiving a loan from the lender (hence being “unsecured”). The template is provided in two formats, and is designed to be quickly filled out.

Note: Refer to the instructions posted below when drafting the form to ensure the note is properly formatted/filled out.

How to Write

Step 1 – Download the document.

Step 2 – Enter the following:

- Date

- Name of borrower

- Address of borrower

- Name of lender

- Lender’s address

- AND

- Fill in the amount that is to be loaned to the borrower.

- Submit the fixed interest rate that the borrower must pay.

Step 3 – Payments – The borrower must agree to pay the loan back via one of the three following payment systems:

- No Installments

- Installments

- Interest Only

Step 4 – After selecting the payment method, more information may be required:

- Enter the installment amount

- AND

- Select the installment schedule (monthly OR weekly), and enter the required details.

Step 5 – Due Date – Fill in the final due date of the note.

Note: The full balance, as well as interest/other fees is due by this date.

Step 6 – Interest Due in Event of Default:

- This subsection must contain the interest rate that will be applied to the balance of the note (in the event of a default by the borrower).

Step 7 – Late Fees:

- Provide the period of time the borrower will have to make a past-due payment.

- If the borrower does not make the payment within the aforementioned number of days, they must pay a late fee.

- Submit the amount the borrower will be charged if they miss a payment.

Step 8 – Acceleration:

- The “Acceleration” subsection is required to outline the number of days the borrower will have to cure a default.

Step 9 – Signatures:

- The last subsection of the document MUST contain the date of signing, as well as the printed names of ALL involved parties.

- AND

- The borrower, lender, and witnesses are required to sign the document.

New Mexico Unsecured Promissory Note – Adobe PDF – Microsoft Word