|

Nevada Secured Promissory Note Template |

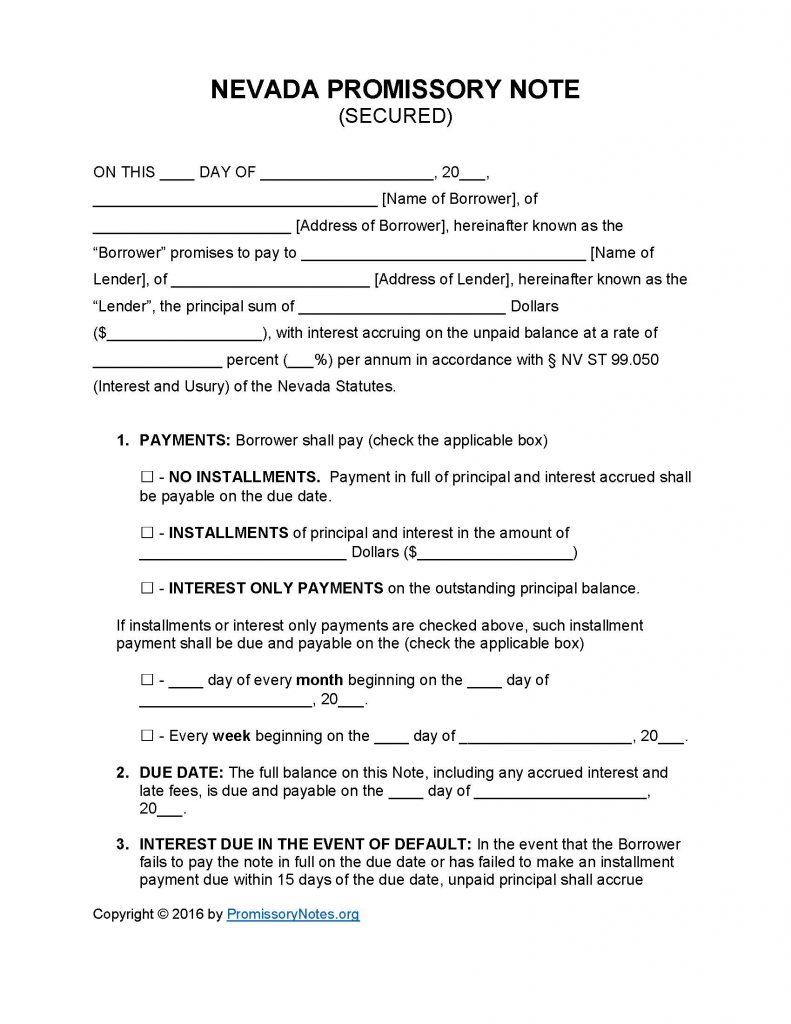

The Nevada Secured Promissory Note Template is a blank legal document that is designed for use in the State of Nevada. The form outlines the principal sum, interest rate, payment schedule/method, and other various terms of a loan. Promissory notes are entered into by a lender and borrower, and must be signed by all involved parties (including witnesses) in order to be legally valid. “Secured” notes require that the borrower pledge collateral (in case they default on the note/loan). In the event of default, the lender may take possession of the collateral in order to satisfy the debt.

How to Write

Step 1 – Download the template in your preferred format (.PDF or Word).

Step 2 – The first paragraph of the note is required to have the following:

- Date

- Name of borrower

- Address of borrower

- Lender’s name/address

- AND

- Provide the principal sum of the loan

- Fill in the interest rate

Step 3 – Payments – Submit the following information into the appropriate input fields:

- Payment method (check the box of the agreed upon method).

- Installment amount (if “Installments” is the selected method).

- Monthly/weekly installment frequency (if “Installments” or “Interest Only” is the chosen method).

Step 4 – Due Date:

- Fill in the date in which the full sum of the note is due (including additional fees/interest).

Step 5 – Interest Due in Event of Default:

- Provide the interest percentage that will be applied to the balance of the note if the borrower ends up defaulting (on the loan).

Step 6 – Late Fees:

- Enter how long the lender will give the borrower to make a past-due payment (before they will be charged with a late fee).

- Submit the amount the borrower will be charged if they miss a payment.

Step 7 – Acceleration:

- The lender shall provide the borrower with a certain number of days to cure a default on the note.

- Fill in how long the borrower will have (in days) to cure a default.

Step 8 – Security:

- This subsection must contain a description of the borrower’s pledged security.

Step 9 – Signatures – The last subsection of the document MUST contain the following:

- Date

- Names of borrower, lender, AND witnesses

- Signatures of ALL Parties involved (borrower, lender, and witnesses)

Nevada Secured Promissory Note – Adobe PDF – Microsoft Word