|

Oklahoma Unsecured Promissory Note Template |

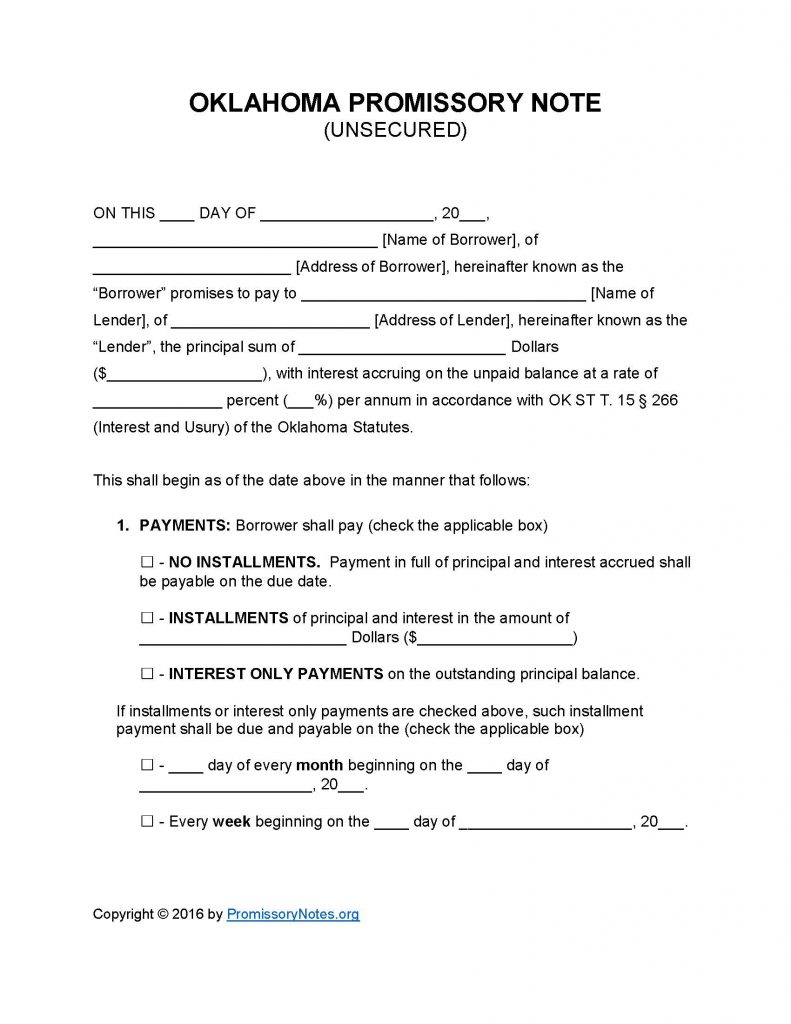

The Oklahoma Unsecured Promissory Note Template can be downloaded in .PDF or Word format. The template is designed to be used as a starting point when drafting an unsecured promissory note. Unsecured notes are a type of loan agreement, which in contrast to secured notes, do not require the borrower to pledge security (aka collateral). Another key aspect of unsecured notes is that they typically have higher interest rates than secured ones, due to not having the backing of collateral.

How to Write

Step 1 – Download the document.

Step 2 – The following information must be entered into the opening paragraph of the form:

- Date of note

- Name/address of borrower

- Name/address of lender

- Principal sum of loan

- Interest rate

Step 3 – Payments – There are three possible payment options; select one of the following:

- No Installments

- Installments – the payment amount must be provided.

- Interest Only

Note: “Installments” or “Interest Only” requires the monthly/weekly payment schedule information.

Step 4 – Due Date – The agreed upon date that the borrower will have until, to pay the full sum of the loan back to the lender.

Step 5 – Interest Due in Event of Default:

- Submit the interest rate that the borrower must pay if they default on the loan.

Step 6 – Late Fees:

- If the borrower does not make a payment by the scheduled due date (or within the allotted time period after the due date), they will be issued a late payment fee.

- Submit the amount of the fee.

Step 7 – Acceleration:

- Enter the period of time, after defaulting on the loan, that the borrower will have to “cure” the default.

Step 8 – Signatures – This subsection must be completed in its entirety in order for the document to be legally enforceable:

- Submit the date

- Enter the names of ALL parties.

- The borrower, lender, and witnesses MUST sign the form in the appropriate input fields.

Oklahoma Unsecured Promissory Note – Adobe PDF – Microsoft Word