|

Rhode Island Secured Promissory Note Template |

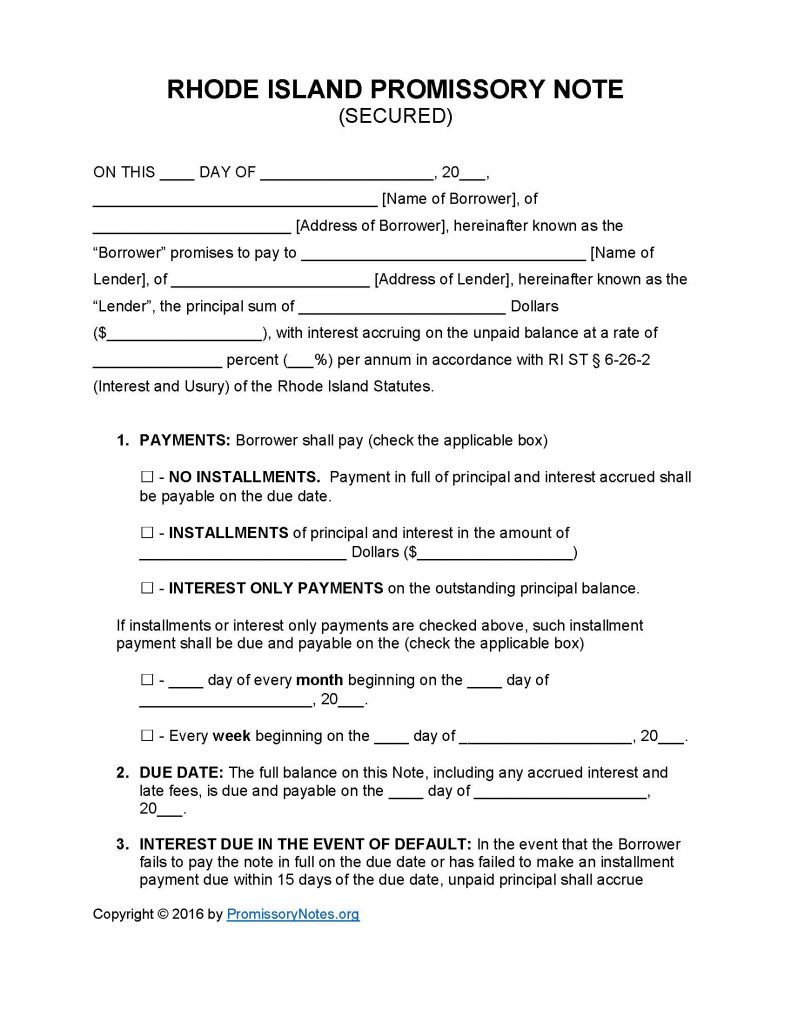

The Rhode Island Secured Promissory Note Template is a legally enforceable document that’s used to outline the specific terms of a loan (including the interest rate, principal sum, payment frequency, etc.). The template, available for download on this page, is designed to be used as a starting point when drafting secured notes. The main requirement of a secured promissory note (that differentiates it from an unsecured note), is the pledging assets from the borrower (i.e. security).

Note: The document MUST be signed by the lender, borrower, and witnesses.

How to Write

Step 1 – Download the template.

Step 2 – Submit the following details into the corresponding input fields of the opening paragraph:

- Date

- Name/address of borrower

- Name/address of lender

- Amount of loan

- Agreed upon interest rating (per annum)

Step 3 – Payments – The payment method must be selected by checking the appropriate box:

- No Installments

- Installments – the payment amount must be provided.

- Interest Only

Step 4 – If the method of repayment is either “Installments” or “Internet Only,” the payment frequency (monthly or weekly) must be entered.

Step 5 – Due Date – This subsection must contain the final date in which the principal sum of the note must be paid off by.

Step 6 – Interest Due in Event of Default:

- Fill in the interest rating that the borrower will be charged if the note/loan goes into default.

Step 7 – Late Fees:

- Submit the number of days the borrower will have to make a scheduled payment (after the first due date has been missed).

- Submit the amount that the borrower will be charged if they fail to make a payment.

Step 8 – Acceleration:

- This subsection details how long the borrower will have after defaulting to cure the default.

Step 9 – Security:

- Enter the pledged assets of the borrower.

Step 10 – Signatures:

- Fill in the date.

- Provide the printed names of the borrower/lender.

- Submit the names of the witnesses.

- Borrower, lender, and witnesses are required to sign the document.

Rhode Island Secured Promissory Note – Adobe PDF – Microsoft Word