|

South Carolina Secured Promissory Note Template |

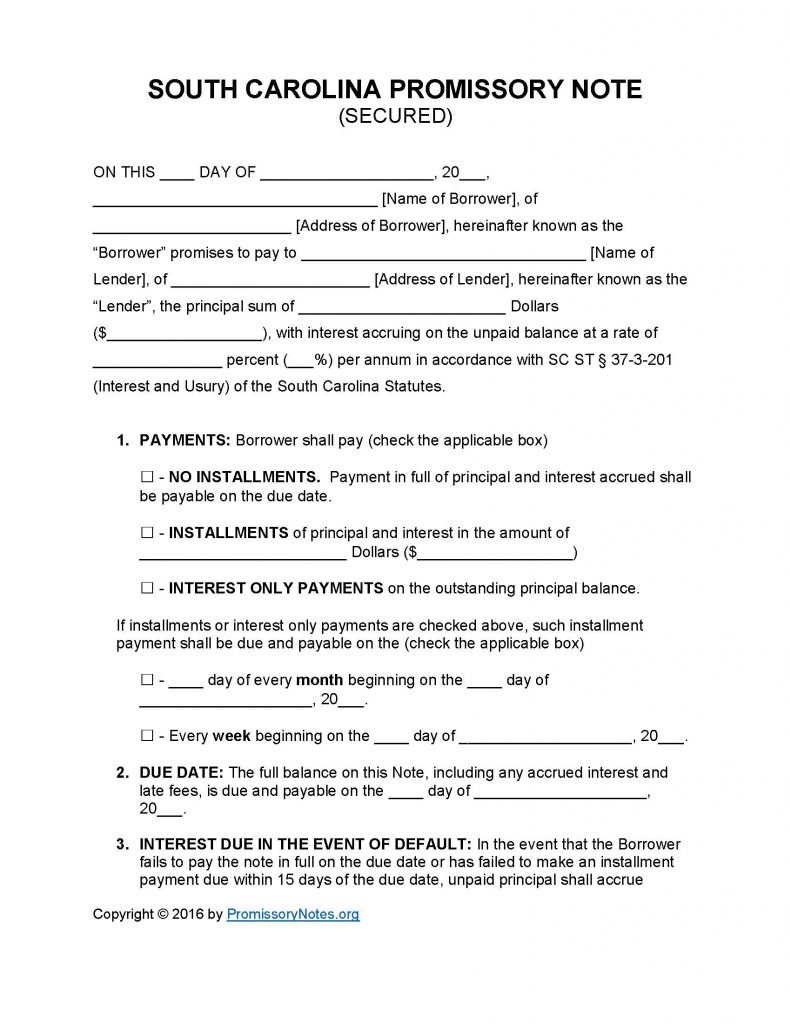

The South Carolina Secured Promissory Note Template is a legal form that formally enters two parties into an agreement regarding a loan. The document covers such details as the loan’s principal sum, interest rate, payment schedule, and other terms. Use the guide in the how-to section below as a reference when filling out the template.

How to Write

Step 1 – Download the document in your preferred file format.

Step 2 – The opening paragraph of the form is required to have the following information submitted:

- Name/address of borrower

- Name/address of lender

- AND

- The principal sum must be submitted.

- The interest rate is required to be entered.

Step 3 – Payments – This subsection must contain the repayment method as well as other required details:

- Select the payment method.

- Enter the installment amount (if applicable).

- Provide the monthly/weekly due date information (if required).

Step 4 – Due Date:

- Fill in the date in which the borrower has until to repay the full principal sum of the note.

Step 5 – Interest Due in Event of Default:

- The interest rate submitted in this subsection is what the borrower will be charged if they default on the loan.

Step 6 – Late Fees:

- Enter the period of time that will be provided to the borrower (after they have missed a payment) before a late fee will be charged.

- Fill in the amount that will be charged.

Step 7 – Acceleration:

- Submit how long the borrower will have to cure a default (before the lender can take further action).

Step 8 – Security:

- The document must contain a description of the pledged collateral. Enter the description into this subsection.

Step 9 – Signatures:

- Enter the date.

- Submit the name of the borrower.

- Borrower must sign the form.

- Submit the names of the lender and witnesses.

- Lender/witnesses must sign the document.

South Carolina Secured Promissory Note – Adobe PDF – Microsoft Word