|

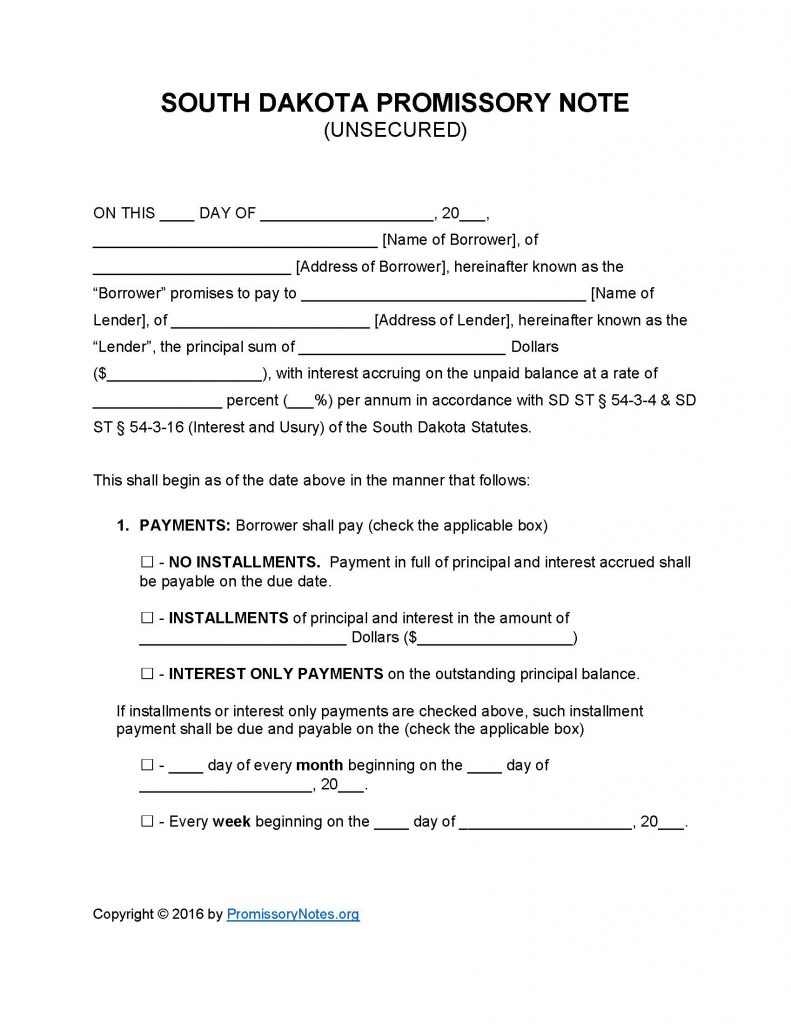

South Dakota Unsecured Promissory Note Template |

The South Dakota Unsecured Promissory Note Template can be used to draft the terms of a loan agreement. The document, entered into by a borrower and lender, is legally enforceable (provided it has been properly formatted/signed/etc.). “Unsecured” promissory notes do not require the borrower to pledge collateral (as opposed to secured notes). For this reason, unsecured notes/loans typically feature higher interest rates (due to the inherent risk involved for the lender).

How to Write

Step 1 – Download the template in .PDF or Word format.

Note: The .PDF form can be completed electronically.

Step 2 – The first paragraph of the note should contain the following details:

- Date

- Names of borrower/lender

- Addresses of borrower/lender

- Amount of loan

- Interest rate that borrower will be charged

Step 3 – Payments – There are three possible payment options, select one from the following:

- No Installments

- Installments

- Interest Only

Note: If “Installments” is selected the payment amount must be submitted. If either “Installments” or “Interest Only” is the chosen method then the payment frequency details must be entered.

Step 4 – Due Date – This subsection details the date in which the full balance of the note (including any fees/interest charges) must be paid off by.

Step 5 – Interest Due in Event of Default:

- Fill in what interest rate the borrower will be charged (in the event of a default).

Step 6 – Late Fees:

- If the borrower misses a scheduled payment, they will have X number of days to make the past-due payment.

- If the borrower fails to make the payment within the number of days submitted in this subsection, the lender can charge a late fee to the account (submit the late fee amount).

Step 7 – Acceleration:

- Provide how long the borrower will have to cure a default.

- Failure of the borrower to cure the default provides the lender with the right to take legal action.

Step 8 – Signatures:

- Submit the date in the first input field.

- Enter the names of the borrower/lender (printed).

- The borrower AND lender must sign the note.

- The witnesses must submit their names/signatures.

South Dakota Unsecured Promissory Note – Adobe PDF – Microsoft Word