|

Texas Secured Promissory Note Template |

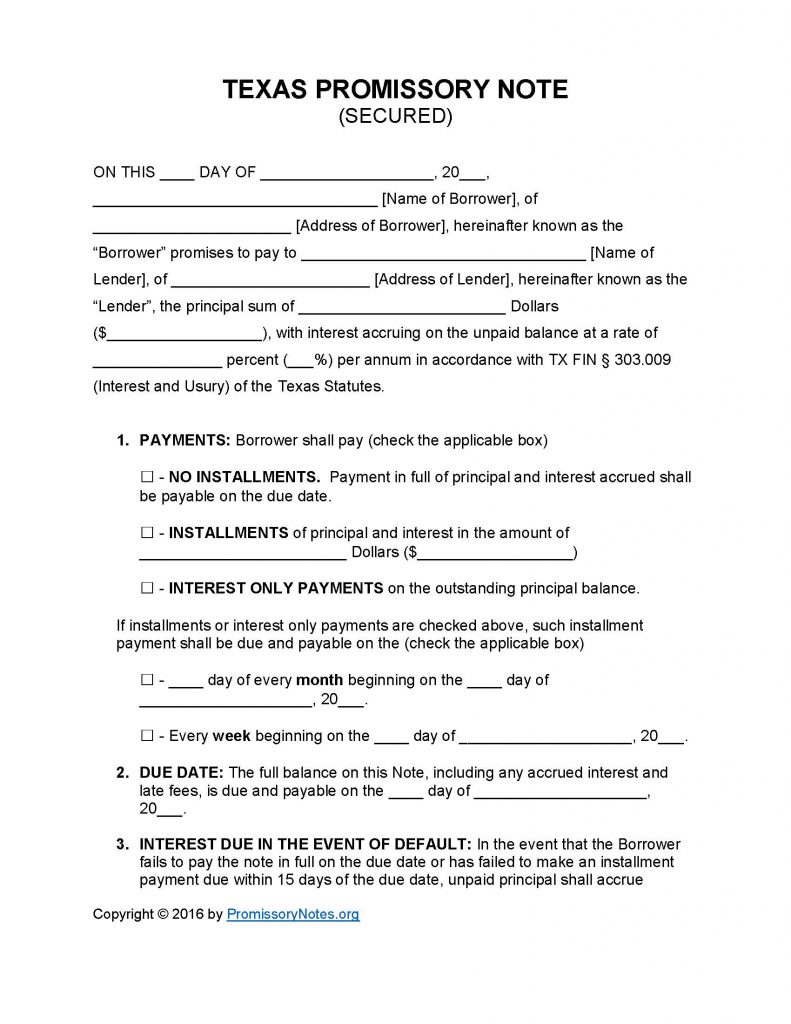

The Texas Secured Promissory Note Template is available for download via the links on this page (in two forms – .PDF or Word). The template can only be used to draft a secured note, not an unsecured one. The main difference between the two types of notes is that secured promissory notes have the backing of the borrower’s assets (i.e. security). In order for the document to be enforceable in court, it must be properly drafted (as well as signed by the borrower, lender, and witnesses).

How to Write

Step 1 – Download the template.

Step 2 – Submit the following information into the corresponding input fields within the first paragraph of the note:

- Date of agreement

- Names of lender/borrower

- Addresses of lender/borrower

- Principal sum

- Interest percentage (per annum)

Step 3 – Payments – The “Payments” subsection is required to have the following information:

- Method of payment (check the applicable box).

- Installment amount (if required).

- Monthly/weekly due date (if applicable).

Step 4 – Due Date:

- Submit the due date of the full balance of the note (including any fees, interest, etc.).

Step 5 – Interest Due in Event of Default:

- Fill what the interest rate will be if the borrower defaults on the loan.

Step 6 – Late Fees:

- Submit the number of days that the borrower will have to make a past-due payment on the note. If the borrower fails to make a payment within the allotted period of time, they will be charged a late fee (submit the amount they will be charged).

Step 7 – Acceleration:

- This subsection is required to detail the period of time (after defaulting on the loan) that the borrower will have to cure the default. If the borrower fails to cure the default, the lender can declare the full balance of the note due immediately.

Step 8 – Security – The note must contain a description of the security.

Step 9 – Signatures:

- Enter the date.

- Fill in the names of ALL involved parties.

- ALL parties must sign the note.

Texas Secured Promissory Note – Adobe PDF – Microsoft Word