|

Texas Unsecured Promissory Note Template |

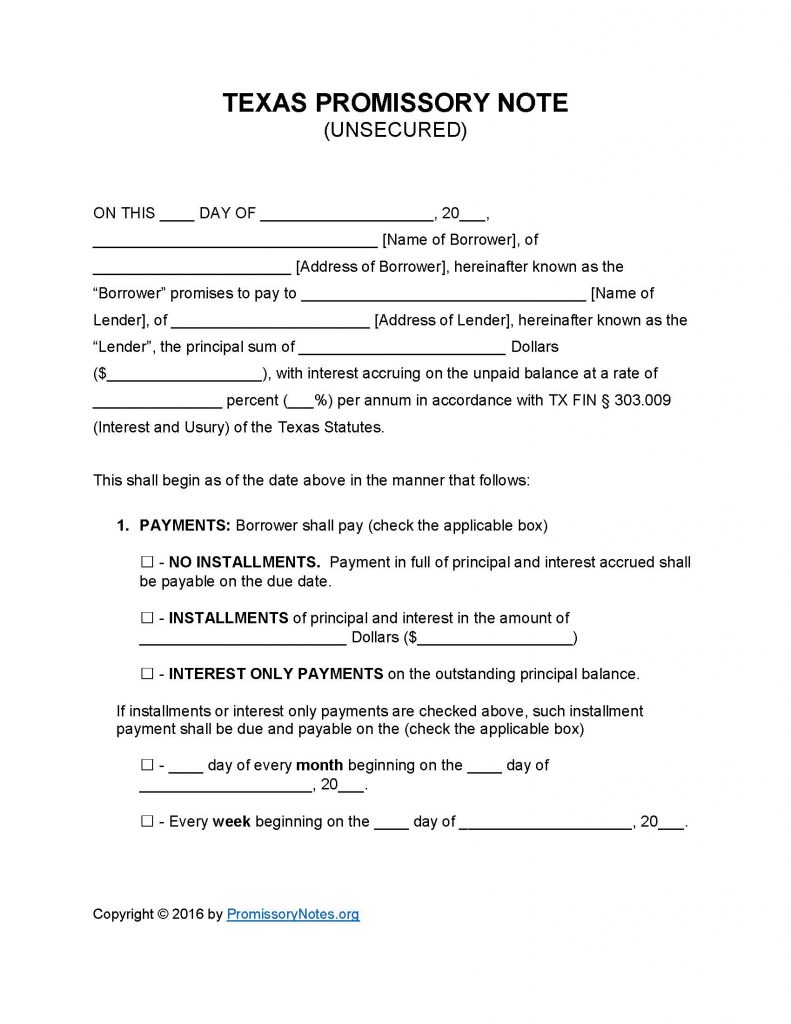

Use the instructions on this page to learn how to complete the Texas Unsecured Promissory Note Template. The template is intended to be used in order to quickly and easily draft an unsecured promissory note. The guide posted below details the various requirements of a promissory note. Use it as a reference when drafting your note.

How to Write

Step 1 – Download the template.

Step 2 – The following information must be submitted into the opening paragraph:

- Date (dd/m/yy format)

- Name of borrower

- Address of borrower

- Lender’s name and address

- Amount of loan

- Amount that will be charged as interest (per annum)

Step 3 – Payments:

- Select the appropriate form of payment (“No Installments” – “Installments” – “Interest Only”).

- If the chosen form of payment is “Installments” enter the amount that will be paid per installment.

- If the method is “Installments” OR “Interest Only” the due date details must be selected/submitted.

Step 4 – Due Date:

- Provide the final due date of the full balance of the loan.

Step 5 – Interest Due in Event of Default:

- Fill in the amount that will be charged (as interest) if the borrower defaults on the loan.

Step 6 – Late Fees:

- Provide the period of time that shall be provided to the borrower, after missing a scheduled installment, to make a payment.

- Fill in the amount that will be charged to the borrower if they fail to make a payment.

Step 7 – Acceleration:

- Submit the period of time, after defaulting on the note, the borrower will have to cure the default.

Step 8 – Signatures:

- Enter the date in the appropriate format.

- Submit the name of the borrower.

- Borrower must sign the note.

- Enter the name of the lender.

- Lender must provide a signature.

- Witnesses must print and sign their names.

Texas Unsecured Promissory Note – Adobe PDF – Microsoft Word