|

Utah Secured Promissory Note Template |

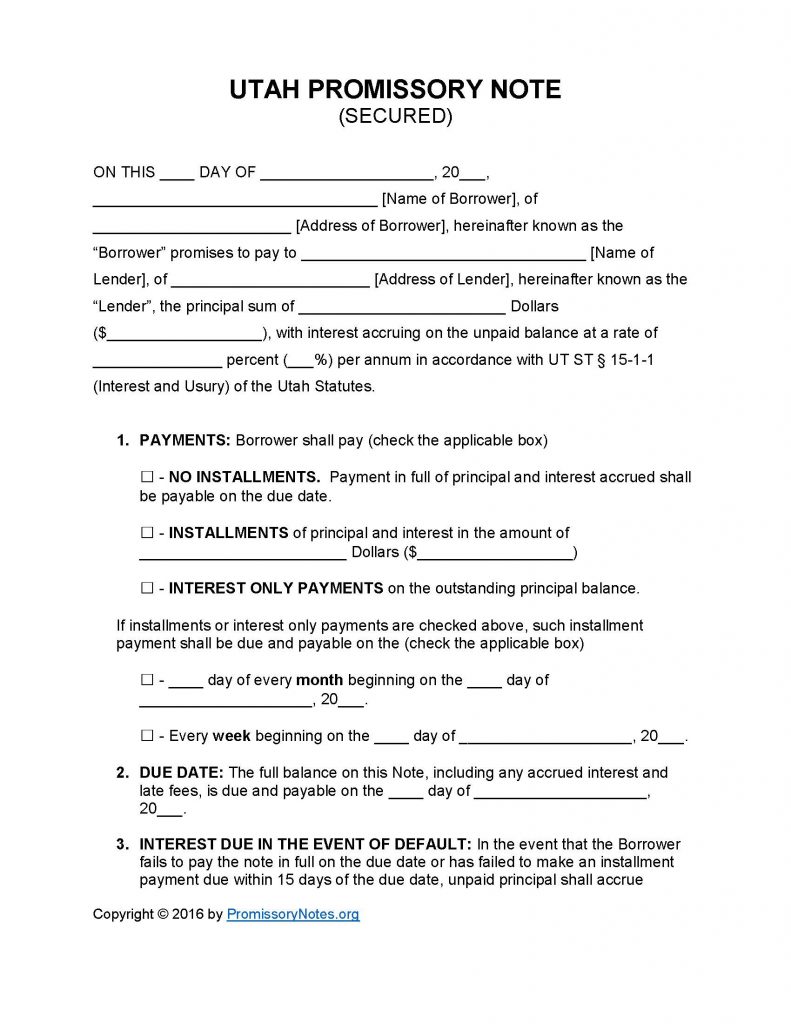

Use the Utah Secured Promissory Note Template to draft a custom secured promissory note. Secured notes, as opposed to unsecured notes, require that the borrower pledge some form of collateral (hence being “secured”). The instructions provided below detail the various requirements of a completed promissory note. Follow the guide to learn how to properly fill out the template.

- Note: After the document has been filled out, it must be signed by all of the involved parties (in order for it to be enforceable by law).

How to Write

Step 1 – Download the form.

Step 2 – Enter the following:

- Date

- Name/address of borrower

- Name/address of lender

- Amount of loan

- Interest rate borrower has agreed to pay

Step 3 – Payments – Submit the payment method by checking the appropriate box:

- No Installments

- Installments* – the payment amount must be entered.

- Interest Only*

- *Provide the monthly/weekly payment frequency.

Step 4 – Due Date:

- Enter the due date of the loan’s entire balance (including fees, interest, etc.).

Step 5 – Interest Due in Event of Default:

- Provide the interest rate that the borrower must pay if they default on the note.

Step 6 – Late Fees:

- Submit the exact number of days the borrower will have, after missing a scheduled installment, to submit a payment.

- AND

- The late fee must be entered.

Step 7 – Acceleration:

- This subsection details how long the borrower will have to cure a default.

Step 8 – Security:

- Submit a detailed description of the borrower’s collateral.

Step 9 – Signatures:

- Fill in the date.

- Provide the names of the borrower, lender, and witnesses.

- Borrower is required to submit a signature.

- Lender must sign the form.

- Witnesses are required to sign their names.

Utah Secured Promissory Note – Adobe PDF – Microsoft Word