|

Wisconsin Secured Promissory Note Template |

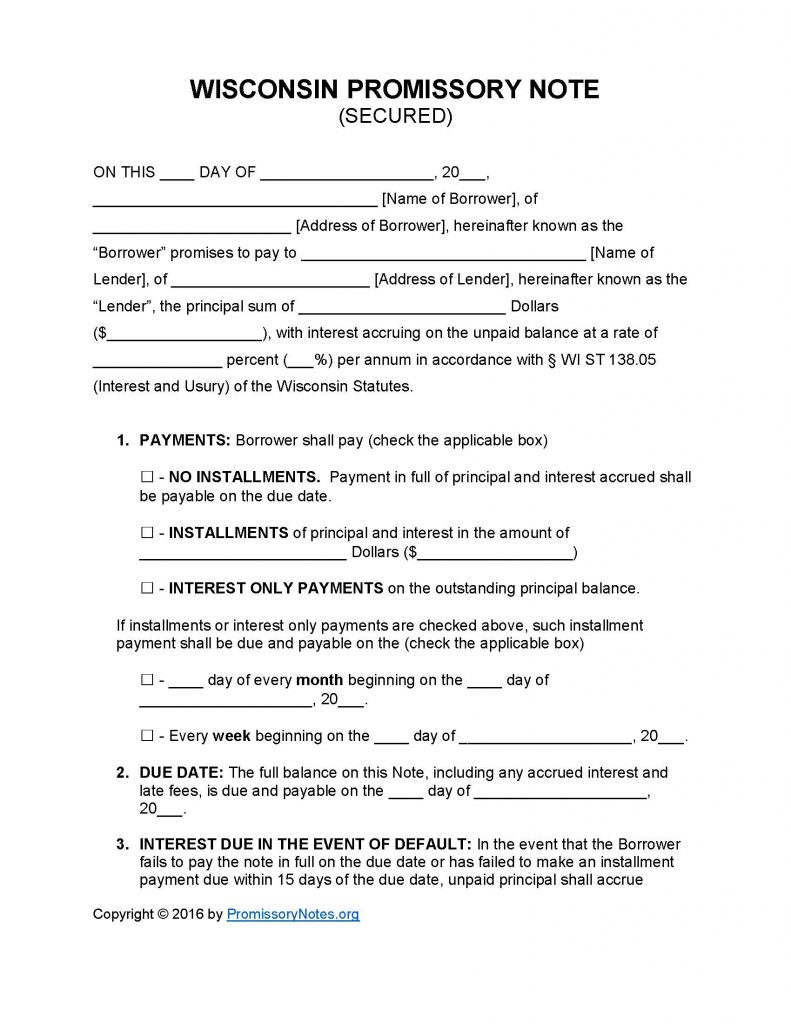

The Wisconsin Secured Promissory Note Template can be downloaded in .PDF/Word format. The document is a legally enforceable agreement between two parties (a lender/borrower), which covers the specific terms of a loan (e.g. principal sum, agreed interest rate, payment method/schedule, etc.). The template available on this page is specifically designed for the creation of a secured promissory note. Do not use this template to create an unsecured note (i.e. a note that does not require collateral).

How to Write

Step 1 – Download the form.

Step 2 – Enter the following information into the opening paragraph’s input fields:

- Date

- Name/address of borrower

- Name/address of lender

- AND

- Fill in the amount of the loan/interest rate

Step 3 – Payments – The payment subsection must contain the following:

- Payment method (check the box of the agreed upon payment method)

- Payment amount

- Schedule (monthly/weekly)

Step 4 – Due Date – Upon signing the document, the borrower agrees to have the principal sum paid off by the date submitted in this subsection.

Step 5 – Interest Due in Event of Default:

- Provide the interest rate that will be charged after the borrower has defaulted on the loan.

Step 6 – Late Fees:

- Fill in the late fee amount.

- AND

- The number of days the borrower will have to make a payment (after failing to send a payment within the specified time period).

Step 7 – Acceleration:

- In the event of a default, the borrower is required to bring the account current within the time period specified in this subsection (else face further action from the lender).

Step 8 – Security:

- Submit a description of the borrower’s pledged security.

Step 9 – Signatures:

- Complete the form by entering the date and names of all of the involved parties.

- Each party must review the entire document, and then sign their name in the input fields within this subsection.

Wisconsin Secured Promissory Note – Adobe PDF – Microsoft Word