|

North Dakota Secured Promissory Note Template |

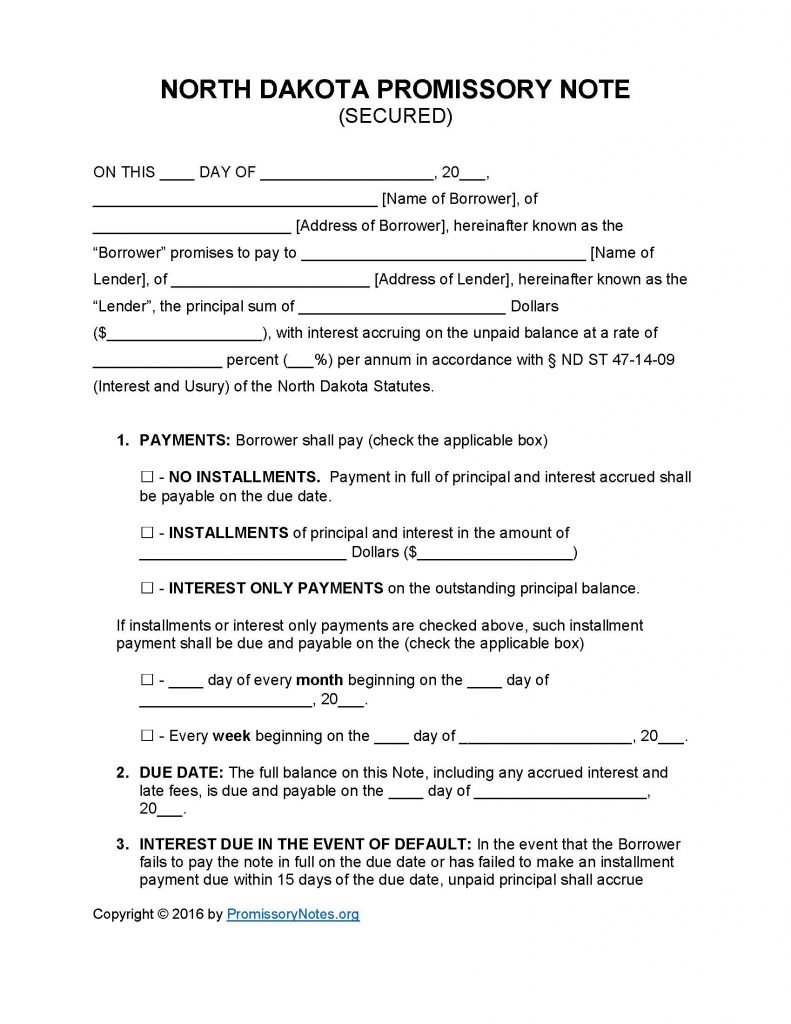

The North Dakota Secured Promissory Note Template is a legally binding document that serves to detail the parties/terms of a loan. The borrower is required to provide security (i.e. collateral) in exchange for receiving the loan. In order for the document to be legally enforceable it must be signed by borrower, lender, and witnesses. Follow the instructions below to learn how to draft the secured note (for use in the State of North Dakota).

How to Write

Step 1 – Download the template.

- Note: The .PDF document is able to be filled out electronically.

Step 2 – The first paragraph of the promissory note should contain the following:

- Date

- Names of borrower/lender

- Addresses of borrower/lender

- AND

- The paragraph must contain the principal sum/interest rate of the loan

Step 3 – Payments – Choose the appropriate payment method from the list of options by checking the corresponding box:

- No Installments

- Installments

- Interest Only

Step 4 – If necessary, provide the following details:

- Installment amount

- Monthly due date OR weekly due date

Step 5 – Due Date:

- Submit the agreed upon date in which the principal sum (in its entirety) is due by.

Step 6 – Interest Due in Event of Default:

- Fill in the interest rate the borrower will be charged if they default on the loan.

Step 7 – Late Fees – Provide the following:

- How long the borrower will have to make a payment (after missing a scheduled payment).

- How much the borrower will be charged if they miss a payment.

Step 8 – Acceleration – In the event of a default, the borrower will have a certain amount of time to “cure” the default.

- Submit how long the borrower will have to cure the default.

Step 9 – Security:

- A description of the secured assets must be provided in this subsection.

Step 10 – Signatures:

- Submit the date.

- In order for the form to be enforceable in court – the borrower, lender, and witnesses must print/sign their names.

North Dakota Secured Promissory Note – Adobe PDF – Microsoft Word