|

Nebraska Secured Promissory Note Template |

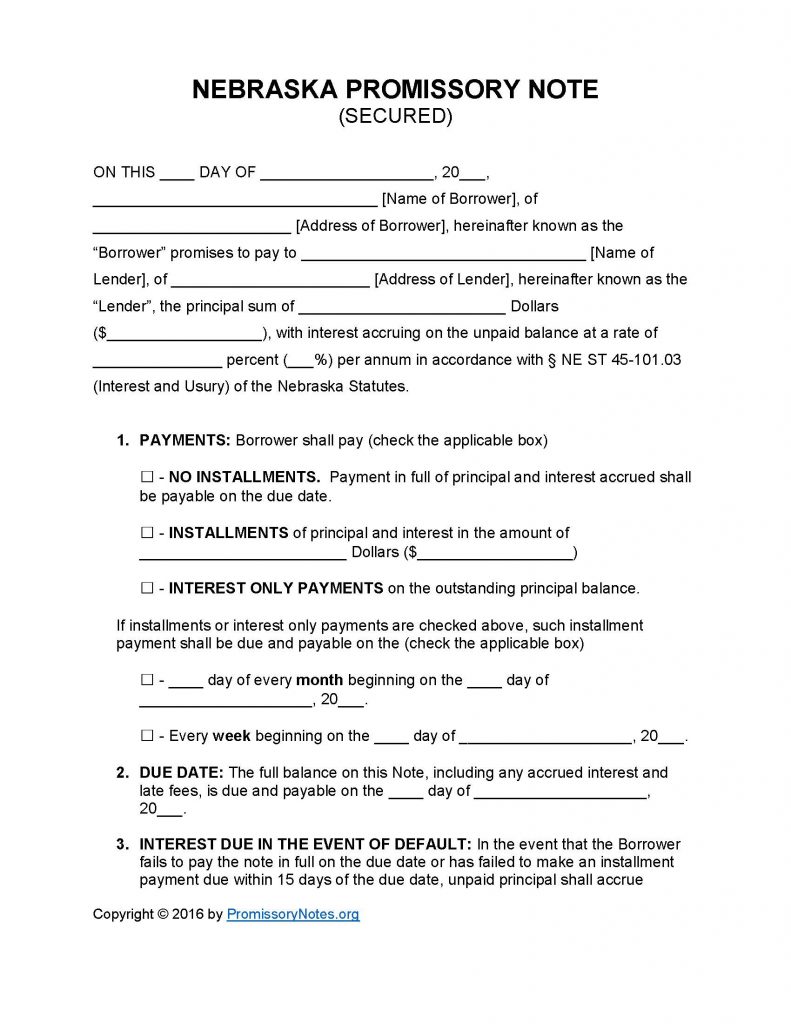

The Nebraska Secured Promissory Note Template is a contractual form, entered into by a lender and borrower, which establishes the specific terms of a loan. The template is available for download in two different formats: .PDF or Word. The instructions posted below provide a guide on how to fill the document out.

How to Write

Step 1 – Download the document.

- Note: The .PDF file can be filled out electronically.

Step 2 – Submit the following required details:

- Date

- Name and address of borrower

- Lender’s name and address

- Principal sum of loan

- Interest rate

Step 3 – Payments – Select the borrower’s payment method:

- No Installments

- Installments – (submit the agreed upon payment amount)

- Interest Only

Step 4 – If applicable, provide the following details:

- Monthly due date

- OR

- Weekly due date

Step 5 – Due Date:

- Submit the required due date information.

Step 6 – Interest Due in Event of Default:

- In the event of a default on the note, the borrower will be charged a new interest rate.

- Submit the interest rate that will be applied if the borrower defaults on the note or loan.

Step 7 – Late Fees:

- Fill in the number of days the borrower shall have to make a payment (after they have missed the agreed upon due date).

- Submit the additional charge that will be applied to the account if the borrower does not make a payment within the time period mentioned above.

Step 8 – Acceleration:

- Enter how long the borrower will have after defaulting to “cure” the default. If the borrower fails to cure the default within the specified time period, the lender can take further action (file a civil suit, etc.).

Step 9 – Security:

- Fill in a description of the borrower’s pledged assets.

Step 10 – Signatures – Provide the following:

- Date

- Name of borrower

- Name of lender

- Names of witnesses

- AND

- Signature of borrower

- Signature of lender

- Signatures of witnesses

Nebraska Secured Promissory Note – Adobe PDF – Microsoft Word