|

Vermont Secured Promissory Note Template |

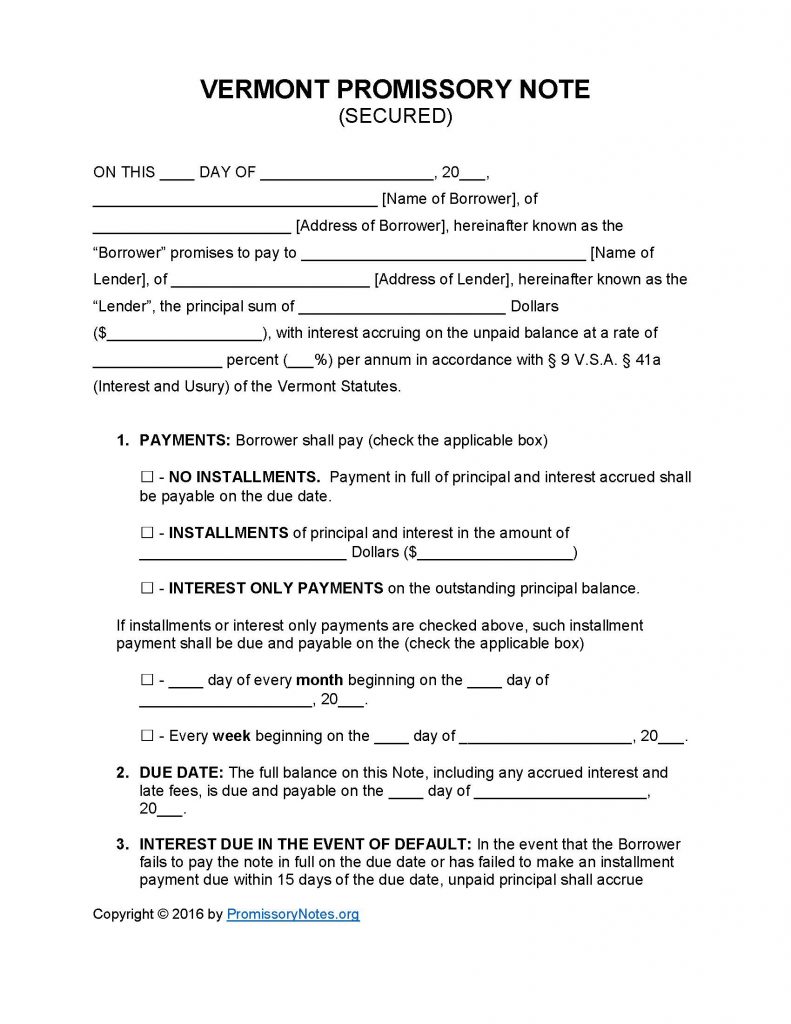

The Vermont Secured Promissory Note Template is a .PDF/Word document that can be used to quickly create a secured promissory note. Once completed, the form will outline the required terms of a loan (such as the interest rate, principal sum, payment schedule, etc.). It should be noted that one of the main requirements of a “secured” note is the pledging of collateral from the borrower. Once the form has been completely filled out, it must be signed by the borrower/lender (and witnesses) in order to be permissible in court.

How to Write

Step 1 – Download the document.

Step 2 – In the first paragraph of the form submit the following:

- Date of note

- Borrower’s name/address

- Lender’s name/address

- Amount of loan

- Interest rate

Step 3 – Payments – Select the payment method the borrower has agreed to use:

- No Installments

- Installments

- Interest Only

Step 4 – If the payment method is “Installments” or “Interest Only” – the monthly or weekly due date information is required to be provided.

Note: Submit the “Installment” amount if required.

Step 5 – Due Date:

- Fill in the date in which the principal sum (in addition to any fees/interest charges) is due by.

Step 6 – Interest Due in Event of Default:

- In the event of a default, the borrower will be charged an additional interest rate. Submit the amount that the borrower will be charged.

Step 7 – Late Fees:

- Provide how long the borrower will have (after not making a scheduled payment) to pay the due amount before the lender will charge a late fee.

- Enter the amount that will constitute the late fee.

Step 8 – Acceleration:

- Submit the period of time that the borrower will be provided, post-default, to “cure” the default.

Step 9 – Security:

Provide a description of the borrower’s pledged asset(s).

Step 10 – Signatures:

- Enter the date, and then fill in the printed names of each party.

- Borrower is required to provide a signature.

- Lender must sign the form.

- Each witness must sign their name.

Vermont Secured Promissory Note – Adobe PDF – Microsoft Word